Correcting E-file Rejection Errors

After an e-file is created and transmitted to the taxing agency, or if a return is accepted with messages from the taxing agency, there is always the possibility that it may be rejected by the agency. If one of your Federal or state e-files is rejected, you must correct the errors, re-create the e-file, and re-transmit it. Failure to correct all errors will cause the return to be rejected again.

To fix e-file rejection errors, re-create the e-file and re-transmit it:

- Select E-file Manager.

- Select the Rejected filter check box.

- Select the rejected return you want to correct.

- Click the E-file menu; then, select Display Rejection Errors.

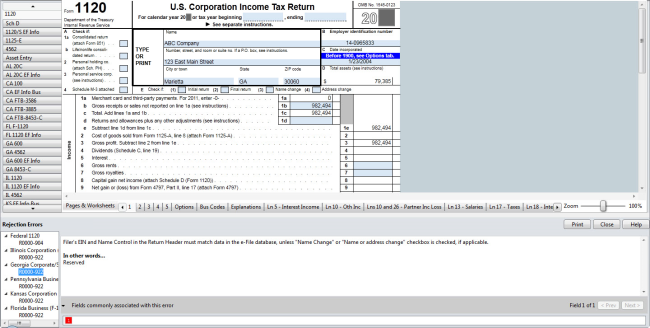

The return opens, and the E-file Rejection Errors pane displays the errors, number of errors, and fields in which they are located.

- Click a specific error (in red) to navigate to the field containing the error.

- Correct the error.

If the error is in a field on a form, the form appears and the cursor is placed in that field.

- After you have corrected the errors, re-create the e-file. See Creating E-files.

- Transmit the re-created e-file to the EFC

See Transmitting E-files.

If you get an error referring to a duplicate Submission ID simply re-create the e-file to correct the error. The system will generate a new Submission ID. See E-file ID.

See Also: